Included in the Congressional government spending bill for fiscal 2020 was a measure to revive the $1 per gallon tax credit for biodiesel, according to a report from Agri-Pulse. The tax credit that subsidizes biodiesel and renewable biodiesel production lapsed at the end of 2017, but this new ruling will be applied retroactively through 2018 and be in effect until 2022.

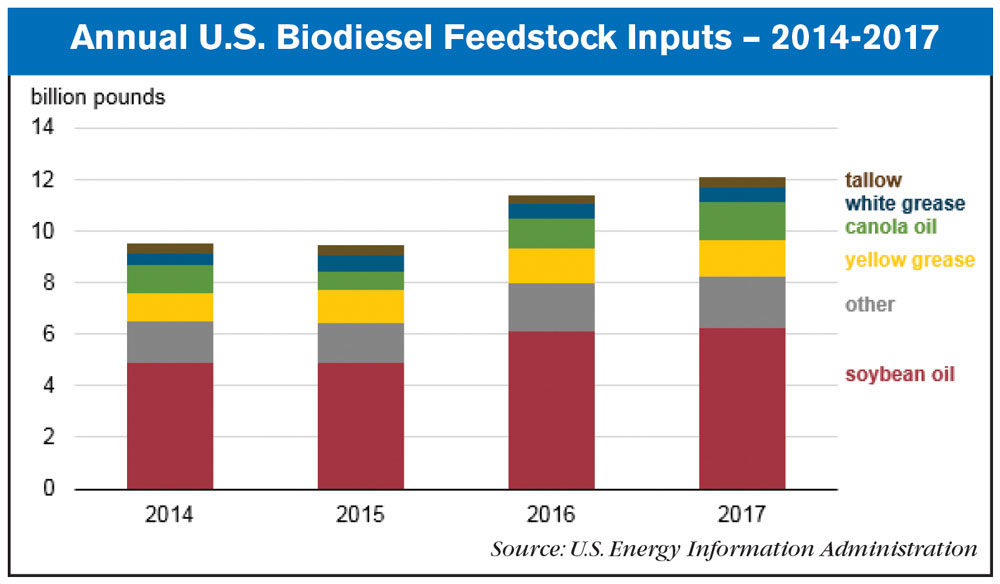

With the rough 2019 planting season that impacted many farmers across the Midwest, the tax credit could provide crucial support to those producing the feedstock that goes into biodiesel production, particularly soybean farmers. According to a report from the U.S. Energy Information Administration, the amount of soybean feedstock being used to create biodiesel has increased by nearly 1 billion pounds between 2014 and 2017.

Senate finance committee chairman Chuck Grassley, a main proponent of the tax credit revival, said, “After years of uncertainty for many Americans, we’ve finally come to an agreement on the future of these temporary tax policies. Many people in my state, farmers and processors alike, can breathe a sigh of relief that Congress will extend the biodiesel tax credit retroactively and through 2022."

Post a comment

Report Abusive Comment