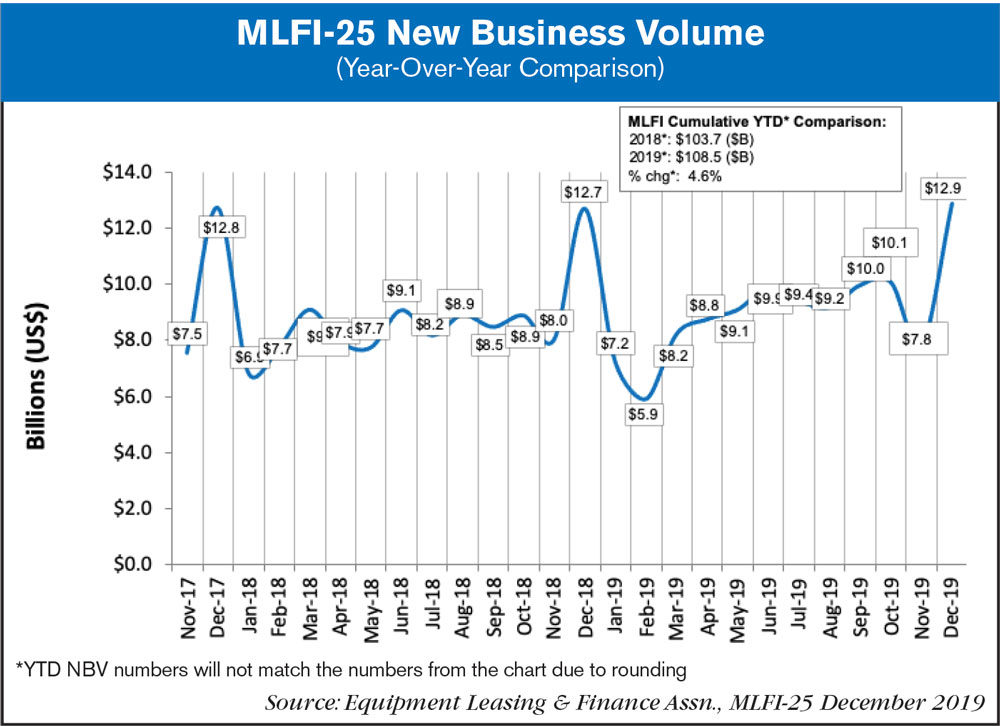

The Equipment Leasing and Finance Assn.’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector, showed their overall new business volume for December was $12.9 billion, up 2% year-over-year from new business volume in December 2018. Volume was up 655 month-to-month from $7.8 billion in November in a typical end-of-year spike. Cumulative new business volume for 2019 was up 5% from 2018.

Receivables over 30 days were 2.2%, up from 1.8% the previous month and up from 1.7% the same period in 2018. Charge-offs were 0.5%, up from 0.4% the previous month, and down from 0.6% in the year-earlier period.

Credit approvals totaled 77.1%, up from 75.7% in November. Total headcount for equipment finance companies was down 3.3% year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in January is 59.9, an increase from the December index of 56.2.

Click here for a full list of participants.

ELFA President and CEO Ralph Petta said, “Equipment finance companies ended the year with steady 5% cumulative new business growth. However, some ELFA member organizations are seeing slightly elevated levels of stress in their portfolios, corroborating evidence that soft patches can be found in some sectors of the U.S. economy. Whether recent relaxation of nagging trade tensions between the U.S. and several of its trading partners improves conditions in the industrial and ag sectors of the U.S. economy remains to be seen as we move deeper into the new year.”

Post a comment

Report Abusive Comment