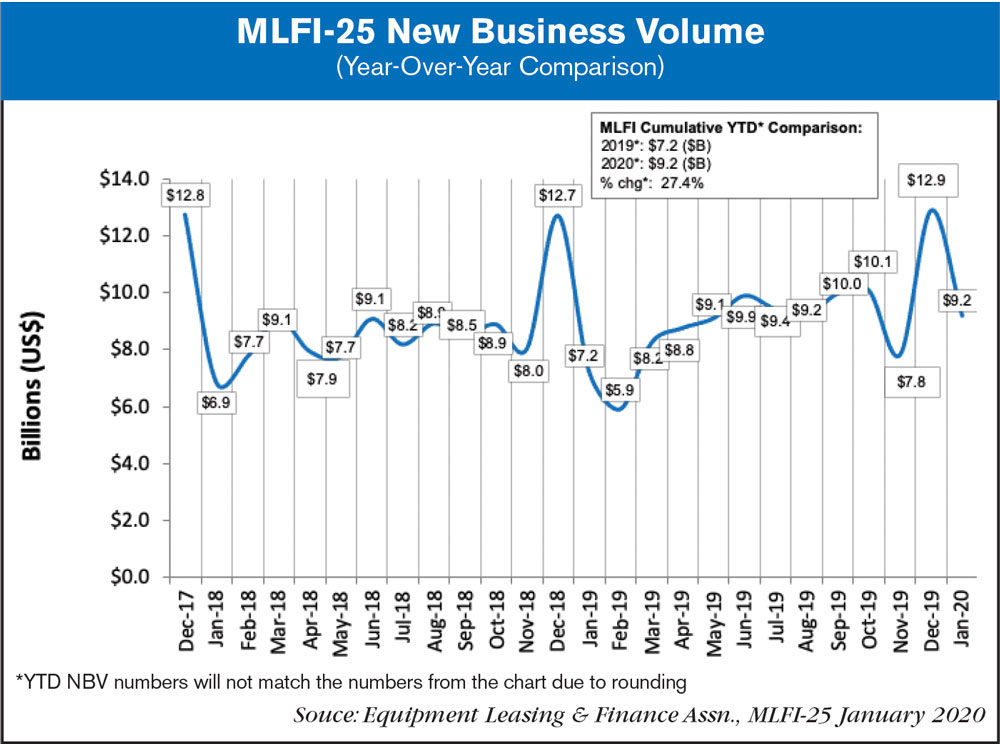

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector, showed their overall new business volume for January was $9.2 billion, up 28% year-over-year from new business volume in January 2019. Volume was down 29% month-to-month from $12.9 billion in December following the typical end-of-quarter, end-of-year spike in new business activity.

Receivables over 30 days were 2%, down from 2.2% the previous month and unchanged from the same period in 2019. Charge-offs were 0.5%, down from 0.5% the previous month and up from 0.4% in the year-earlier period.

Credit approvals totaled 76.3%, down from 77.1% in December. Total headcount for equipment finance companies was down 3% year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in February is 58.7, easing from the January index of 59.9.

ELFA President and CEO Ralph Petta said, “The year starts off with a bang as January new business volume increases dramatically on a year-over-year basis. Underlying fundamentals in the U.S. economy (strong job growth, low inflation, low interest rates, continuation of a bull equities market and solid business confidence) all add up to a growing demand for productive equipment necessary to keep businesses expanding and profitable.”

Stephen Hamilton, Chairman and CEO, CSI Leasing, Inc., said, “2019 was another record year for CSI, with lease originations up 15% worldwide to over $1.4 billion, led by a strong increase of 23% in our U.S. business. Back office efficiencies and use of technology have allowed this to occur with no increase in our U.S. leasing headcount. Our traditional focus on successful middle-market to large corporate customers has resulted in continued strong credit performance with minimal write-offs. Optimism is high for 2020, with a solid start in January and a record pipeline of first quarter business on tap, although we expect uncertainty regarding the impacts of the coronavirus and the November elections could slow customer decision-making in coming months.”

Post a comment

Report Abusive Comment