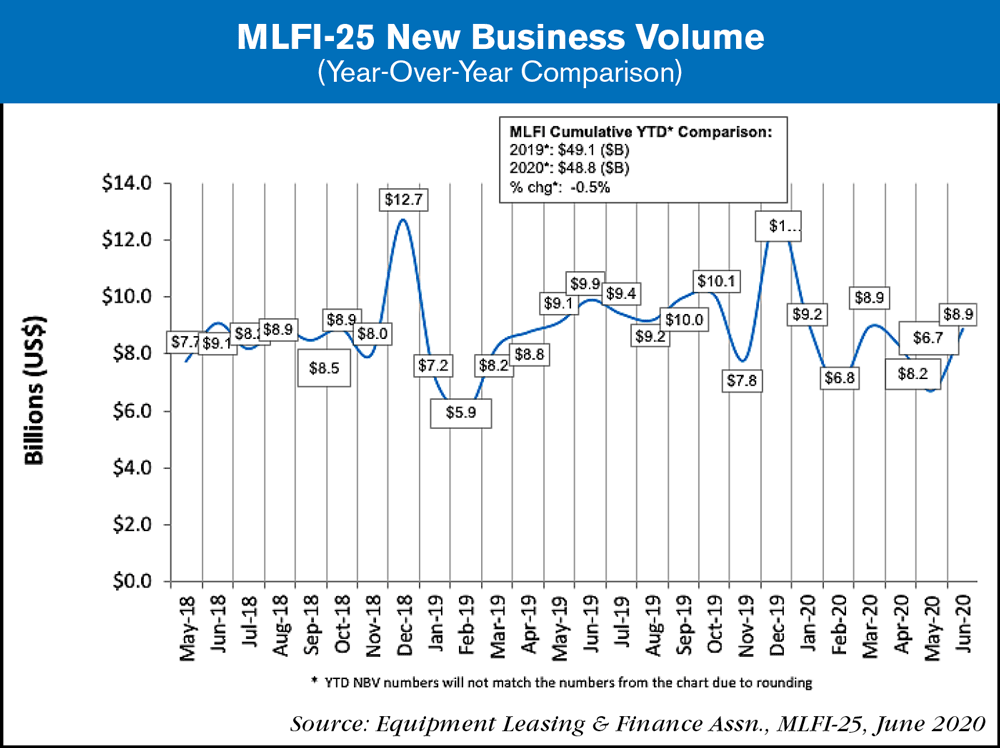

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector, showed their overall new business volume for June was $8.9 billion, down 10% year-over-year from new business volume in June 2019. Volume was up 33% month-to-month from $6.7 billion in May. Year-to-date, cumulative new business volume was down 0.5% compared to 2019.

Receivables over 30 days were 2.6%, down from 4.3% the previous month and up from 1.7% the same period in 2019. Charge-offs were 0.71%, up from 0.61% the previous month, and up from 0.33% in the year-earlier period.

Credit approvals totaled 71.5%, up from 71.% in May. Total headcount for equipment finance companies was down 1.9% year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in July is 45.3, steady with the May index of 45.8.

ELFA President and CEO Ralph Petta said, “The month of June’s pickup in new business volume is welcome news, but it remains to be seen whether this trend continues as the summer progresses. The economy is soft, too many employees are out of work as a result, and many states are struggling with the decision to re-open their economies. Depending on the specific sectors they support, some ELFA member companies report robust originations, while others are challenged putting new deals on their books.”

Justin Tabone, SVP Originations, Vendor Equipment Finance at TIAA Bank, said, “The month-to-month results provide some evidence that activity picked up, but the pandemic is still creating significant uncertainty for the equipment finance market. As confirmed virus cases sharply rise, the economy is facing re-opening delays, increased social distancing disruptions, and possibly even more lockdown measures. There is still reason for optimism, but these threaten to weigh heavily on the pace of recovery and may present additional challenges for the industry, including reduced capital expenditures and credit deterioration.”