The latest episode of On the Record is now available! In this week’s episode, we look at the record high readings from Purdue University’s Ag Economy Barometer, including improvements in farmers’ equipment purchasing plans. In the Technology Corner Jack Zemlicka discusses dealers expectations for sales of precision farming systems. Also in this episode, a look at where dealers plan to invest in 2021 and the latest earnings reports from Rocky Mountain Dealerships, Cervus Equipment, AGCO and Case IH.

On the Record is brought to you by Ingersoll.

Producers around the globe who till and plant their soil with Ingersoll products enjoy a powerful and real advantage. Ingersoll disc blades and coulters are proven season after season to improve farm productivity and profitability.

Ingersoll discs are precisely built using complex, highly technical processes to be durable, flexible, and maintain the superb cutting ability.

With a modern North American manufacturing location that has produced tillage and planting equipment and components for over 100 years, Ingersoll is dedicated to continue providing the very best to their worldwide customers through innovative products.

Choose Ingersoll for all your high speed, high yield farming solutions.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Ag Economy Barometer Hits Record Highs

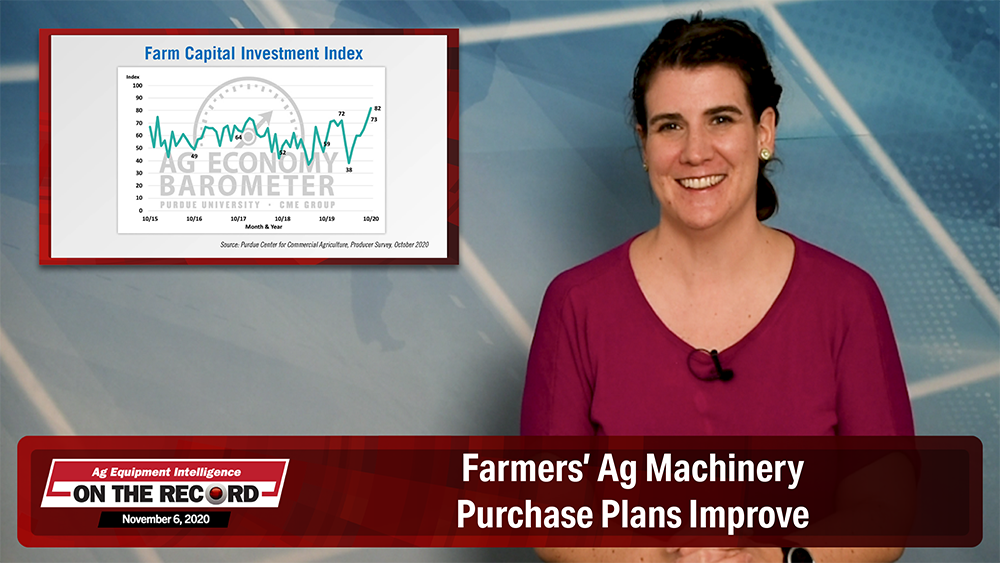

Farmer sentiment hit a new record high in October as the Purdue University-CME Group Ag Economy Barometer climbed to a reading of 183, up 27 points compared to September.

The Farm Capital Investment Index also set a record high in October with a reading of 82, up from September’s reading of 73. The previous record high was 75 set back in December 2015.

Responses to the question regarding farmers’ upcoming farm machinery purchasing plans were the most positive since this question was first posed in March of this year. The percentage of producers expecting to increase their purchases of machinery in the upcoming year rose to 14% from 11% the previous month and up from just 4% back in May. Also of note, the percentage of respondents who plan to reduce their purchases in the next year was 33%, down from 40% in September and just half what it was in May when 65% said they planned to reduce their purchases.

Dealers on the Move

This week’s Dealers on the Move are Ron’s Equipment and Williams Tractor.

Ron’s Equipment, a single-store AGCO dealer in Fort Collins, Colo., announced it will acquire Prospect Implement’s single location in Keenesburg, Colo.

New Holland dealer Williams Tractor is planning a new location in Springdale, La. The 6-store dealership will consolidate multiple locations once the new facility is done.

Most Majors Betting on Precision in 2021

In our last Technology Corner segment, we looked at the precision hiring plans for the coming year, with the majority of the major line farm equipment dealers forecasting increases over 2020.

The outlook supports 93% of dealers view precision farming systems as one of their best bets to remain the same or improve unit sales in 2021, according to Ag Equipment Intelligence’s 2021 Dealer Business Outlook & Trends report.

But digging deeper into each of the major manufacturers outlook for best bets to improve units sales in 2021, not all of them place the same priority on precision in the coming year.

Some 80% of John Deere dealers forecast precision farming system unit sales to increase by at least 2% in 2021, topping the major manufacturer's list of best bets. More than 48% of Case IH dealers cite precision farming systems as a best bet for the coming year, ranking second.

But other dealer groups placed precision lower on their list of expected unit sales growth in 2021. While about 45% of New Holland dealers forecast precision systems to be a best bet, it ranked seventh on the list.

Less than 40% of Kubota, AGCO and Independent dealerships ranked precision among their top opportunities to improve unit sales in 2021.

Despite the mixed outlook among individual manufacturers, there are defined pathways for growth out of lessons learned this year. Layne Richins, precision farming manager at Stotz Equipment, a 25-store Deere dealership, notes a few areas they plan to target in 2021.

“I think some of the keys pieces to that are going to be getting to that next level with our growers and getting more involved in their business. That’s going to bring other opportunities. Maybe it doesn’t necessarily trade-off for equipment sales right away. Maybe it’s just having a seat at the table to understand their business and learn their business. If we can get more involved in our customers’ business, and be more of a partner, that’s just our focus. We believe the precision ag side and the technology, that’s how we can do that.”

You can hear more from Layne Richins who will part of our precision dealer panel at the AEI 2021 Executive Briefing. For more information on the virtual event, visit www.AgEquipmentIntelligence.com.

Where Will Dealers Invest in 2021?

According to Ag Equipment Intelligence’s 2021 Business Outlook & Trends Report, more than half of dealers are planning to invest in the service department in the year ahead.

Just over 53% of dealers surveyed say the plan to invest in their shop and service department in 2021, and nearly 52% of dealers said they will invest in mobile service vehicles. The number of dealers planning to invest in retail/showroom and business information systems were nearly flat.

When broken out by mainline brand, there are some differences in where dealers will invest. Two-thirds of AGCO dealers say they will modernize their shop, while about 55% say they plan to invest in business information systems.

For Case IH, John Deere, Kubota and New Holland dealers, the top two areas to invest were shop & service and mobile service vehicles. For Independent dealers, 40% plan to invest in business information systems.

AGCO, CNHI Report Positive 3Q20 Results

AGCO reported third quarter net sales of $2.5 billion, an 18% year-over-year increase. Year-to-date, AGCO reported total sales of $6.4 billion, down 1.5% year-over-year.

In North America, AGCO reported tractor unit sales up 7%, and combine unit sales up 1%. North American sales totaled $580 million in the third quarter, up 9% year-over-year. Year-to-date North American sales were $1.7 billion, an increase of 2.3%. AGCO says increased sales of high horsepower tractors, hay equipment and Precision Planting products in North America were partially offset by lower grain and protein product, as well as sprayer sales.

CNH Industrial reported third quarter consolidated revenue of $6.5 billion, up 2% year-over-year. Year-to-date, CNH Industrial’s consolidated revenues were down 14% year-over-year in 2020.

Third quarter sales in the agriculture segment totaled $2.7 billion, an 11% year-over-year increase. The company noted that ag equipment demand was up in all key regions in the third quarter. In North America, tractor demand was up 24% for tractors under 140 horseower, up 8% for tractors over 140 horsepower, and combine demand was up 16%. Year-to-date, agriculture sales were down 7% year-over-year.

Cervus Equipment Reports 3Q20 Equipment Revenue Up 14%

Cervus Equipment, the largest retailer of John Deere farm machinery in western Canada, also reported its third quarter earnings this week. The company reported $356 million in third quarter revenue, a 12% year-over-year increase. Year-to-date, total revenue was $954 million, up 8% year-over-year.

Cervus reported equipment revenue up 14% year-over-year in the third quarter and up 11% year-to-date. New equipment revenue rose 9% year-over-year to $89 million in the quarter, and used equipment revenue was up 22% year-over-year to $115 million. Year-to-date, new equipment revenue was up 7% and used equipment revenue was up 25%.

RME Reports Increased 3Q20 Sales, Plans to Go Private

Rocky Mountain Dealerships, Canada’s largest Case IH dealer, recently released its third quarter earnings report.

The company reported a $17 million, or 9.2%, increase in total sales in the third quarter. Used equipment sales increased 10.2%, and new equipment sales increased 4.3%. The company also reported a $135 million year-over-year decrease in total equipment inventory. Year-to-date, Rocky Mountain reported total sales are down $8 million or 1.4% in 2020.

On Nov. 2, Rocky Mountain announced it had entered into an agreement with AcquireCo., an entity controlled by Rocky Mountain’s Chairman Matthew Campbell and President Garret Ganden, that will take the company private. AcquireCo will purchase all issued and outstanding common shares of Rocky Mountain at a 27% premium on the closing share prices as of Oct. 30. The arrangement values Rocky Mountain at $135 million on an equity basis.

Post a comment

Report Abusive Comment