The latest episode of On the Record is now available! In this week's program we review the results of Stifel's fourth quarter dealer survey, which shows used prices increased and inventory "to low." In the Technology Corner, Jack Zemlicka shares some of preliminary results of the 13th annual No-Till Operational Benchmark Study and what it revels about global ag tech adoption. Also in this episode, more on what Deere plans to do with 5G connectivity, a look at how 2020 large ag equipment sales compare to the 5-year average and Krone's 2020 ag sales.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

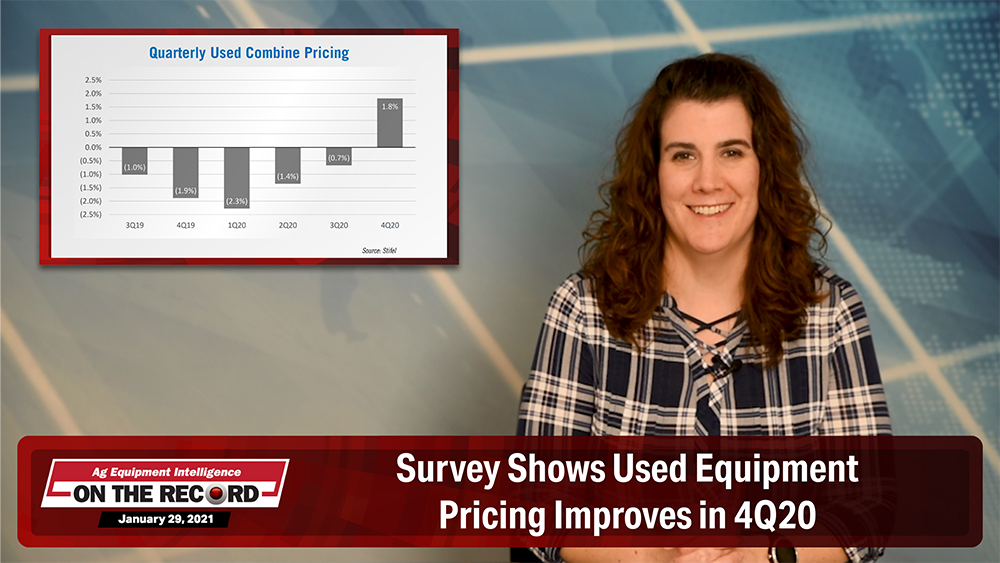

Used Equipment Pricing Improving

Dealers report used equipment pricing improved during the fourth quarter of 2020.

Results from Stifel’s fourth quarter dealer survey show used combine pricing improved 1.8% year-over-year on a weighted average basis in the fourth quarter of 2020. This is the first positive reading since Stifel started surveying dealers a year and a half ago.

Additionally, a net 3% of dealers said their used combine inventory is too low. Stifel analyst Stanley Elliot says, “Used combine pricing has been under slight pressure for a number of years as used inventories have been notoriously too high. We believe this reflects the health of the current large ag equipment market.”

For used large tractors, pricing improved 2.9% year-over-year in the fourth quarter, up from +1.1% in the third quarter of 2020. Additionally, a net 47% of dealers believe inventory levels are too low in this segment as well.

Dealers on the Move

This week’s Dealers on the Move include Hoober Inc., Agri-Service and Cervus Equipment.

Case IH and Kubota dealer Hoober Inc. has purchased the assets of Dubberly Tractor & Equipment in Chester, Va., and has become the regional Kubota, Land Pride and Woods dealer. In addition, Hoober has added the Kubota contract at its Wakefiled, Va., location. The dealership now has 10 locations, 6 of which has the Kubota contract.

Agri-Service, a 9 location AGCO dealer servicing Idaho, Oregon and Washington, has announced the signing of a Letter of Intent to acquire Rathbone Sales Inc., an AGCO dealer located in Moses Lake, Wash., effective April 1, 2021.

John Deere dealership Cervus Equipment has received approval from Red Deer County to build a new location in Penhold, Alta.

Comparing Global Ag Tech Adoption

Progressive farmers continue to bend the ag tech adoption curve, and despite a challenging economic climate, global outlook for adding precision products in 2021 is generally strong.

Preliminary results of the 13th annual No-Till Operational Benchmark Study, with more than 800 U.S. and international farmers participating, reveal some global similarities and stark differences in planned use of precision tools in 2021.

While auto-steer is a universal staple on farms, with 77% of all respondents planning to use the technology this year, U.S. farmers had a higher percentage of expected use of 7 of the 12 precision tools listed in the study.

Most notable are a 21-point differential in planned use of auto-seed shutoff and an 18-point differential in yield monitor and data analysis by U.S. farmers vs. those outside the states.

There were also double-digit variances in forecast use of variable-rate seeding and variable-rate fertilizing by U.S. farmers compared to those outside the country.

However, the initial benchmark study results also reveal some areas where international farmers are trending ahead of those in the U.S. Specifically, planned use of satellite aerial imagery and unmanned aerial vehicles is higher among non-U.S. growers, along with remote sensing.

The largest divide was in the expected use of implement guidance by non-U.S. farmers, 11 percentage points higher than U.S. farmers according to the study.

Look for full coverage of the annual No-Till Benchmark Study, including cropping system breakdowns, nutrient management strategies and on-farm economics in the April issue of No-Till Farmer’s Conservation Tillage Guide.

Deere’s Plans for 5G Manufacturing

John Deere is reportedly in the process of implementing 5G connectivity at several of its Midwest manufacturing facilities, with a focus on utilizing real-time data and autonomy.

In September of last year, John Deere won 5 Citizen Broadband Radio Service, or CBRS, spectrum licenses in an auction put on by the FCC. In a later press release, Deere stated it planned to use these licenses to “accelerate the availability of 5G in its largest manufacturing facilities in North America.”

During the 2021 Consumer Electronics Show, Ag Equipment Intelligence editors caught up with Tami Hedgren, manufacturing lead for tractors and combines at Deere, to talk about what the future holds for Deere and its 5G implementation.

Hedgren explains that Deere’s licenses cover multiple factories across the Midwest, including its Des Moines Works, Waterloo Works and Harvester Works facilities. She says 5G connectivity will allow Deere to gain more from its connected devices in its factories and replace its current hard-wired system of ethernet cables.

“You’ll have to change the infrastructure first. And so we’ll start with, for example, a pilot factory. This is hypothetical, because it’s not all done, but maybe, for example, you start over in an assembly facility. And where you can use this [5G] as an example is real-time information to understand quality opportunities, and what do you have to change in the process real-time to make adjustments?

“Another example would be autonomous part delivery. Our customers struggle with skilled labor, right? And the factories are no different. When schedules go up, labor can be a challenge for us as well. And what 5G allows us to do is not just cover the factory but cover a broader range so we can go from our warehouse to our factory longer-term with autonomous part delivery.”

Hedgren added that Deere is planning to begin implementing a 5G pilot program at its manufacturing facilities by the end of 2021.

HHP Tractors & Combine Sales Up in 2020

According to data from the Assn. of Equipment Manufacturers, 2020 saw increases in all categories of U.S. farm equipment sales, while Canada struggled with its larger equipment sales.

Over 100 horsepower tractor sales in 2020 totaled around 19,200 units in the U.S., up 3.2% from 18,600 the year before. Between 2016 and 2020, average annual sales were about 18,000 units. In Canada, over 100 horsepower tractors sales came in at around 2,900, down 10.5% from 3,200 in 2019. Over the last 5 years, annual high horsepower tractor sales in Canada averaged some 3,500 units.

U.S. combine sales for 2020 came in at about 5,100 units, up 5.5% from 4,800 in 2019. Since 2016, annual U.S. combine sales have averaged roughly 4,600 units. Canadian combine sales, however, totaled 1,500 units, down 13.9% from 1,700 in 2019. Over the last 5 years, annual Canadian combine sales have averaged just under 1,900 units.

Both the U.S. and Canada saw increases in their 40-100 horsepower tractor sales and their compact tractor sales, while only the U.S. reported an increase in 4WD tractor sales.

Krone Reports 2020 Ag Sales Up 5%

According to the company’s latest earnings report, Krone saw a 5% increase in its ag sales last year compared to 2019.

Krone’s Commercial Vehicles Division saw revenues of $1.3 billion in 2020, down 24.2% from $1.8 billion in 2019. Domestic sales were down 24.7% to $450 million, while sales to other markets were down 23.7% to $960 million.Despite an overall decline in global demand for forage harvesting equipment, Krone reported ag equipment revenues of $886 million in 2020, up 4.9% from $845 million in revenue in 2019. The European market accounted for about 70% of Krone’s ag equipment sales, while North America accounted for 15%.

Krone reported $2.3 billion in total revenue in 2020, down 15% from $2.7 billion in 2019. The company’s balance sheet stood at $1.61 billion dollars in 2020, up 2.2% from $1.58 billion.