Bankers responding to the second-quarter survey reported overall better conditions across most regions of the Eleventh District. They noted that recent rainfall has contributed to favorable crop yields, particularly for wheat, corn and cotton. Producers are optimistic about higher commodity prices but worried about increasing input costs. Cattle markets remain relatively steady, though prices are lower than in previous years. Real estate values continue to increase as some farmland and pastureland have been marketed for resale as residential development.

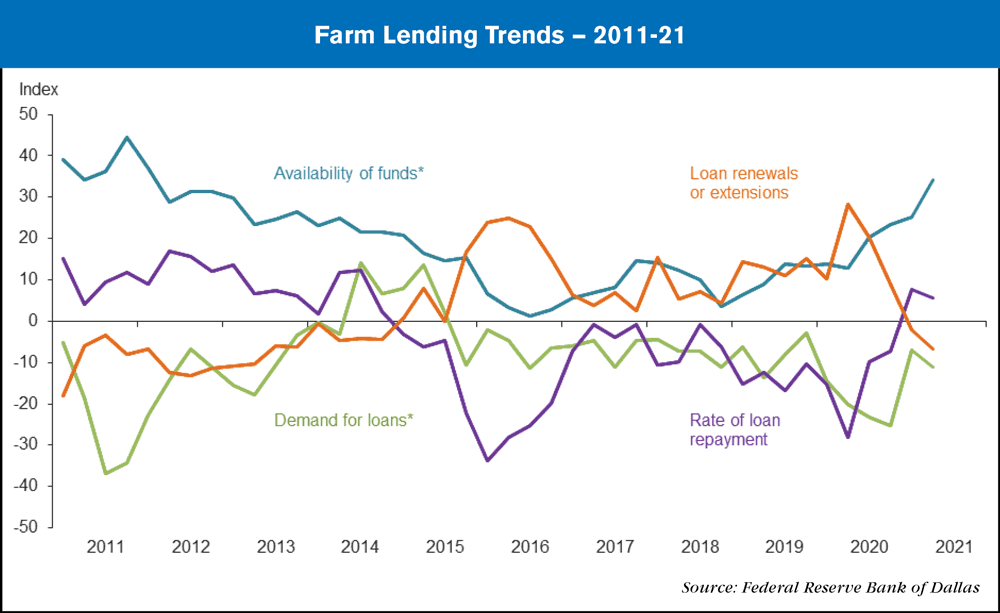

Demand for agricultural loans continued to decline, with the loan demand index registering its 23rd quarter in negative territory. Loan renewals or extensions fell for the second quarter in a row while the rate of loan repayment continued to increase. Loan volume decreased across all major categories compared with a year ago except for farm real estate, dairy and operating loans.

Irrigated, dryland and ranchland values fell this quarter. According to bankers who responded in both this quarter and second quarter 2020, nominal irrigated cropland and ranchland values increased year over year in Texas, southern New Mexico and northern Louisiana.

The anticipated trend in farmland values index grew in second quarter 2021 to its highest historical value, suggesting respondents expect farmland values to continue increasing. The credit standards index fell for the third consecutive quarter but remained in positive territory. The continued positive value of the index indicates further tightening of standards on net.

Post a comment

Report Abusive Comment