In this week's episode we take a look at the latest Dealer Sentiments & Business Conditions survey, which shows used combine inventories reaching a record low. In the Technology Corner, Ben Thorpe discusses the findings of study done by the Assn. of Equipment Manufacturers, the American Soybean Assn., Crop-Life America and the National Corn Growers Assn., on the environmental benefits of precision ag technology. Also in this episode the House Ag Committee approves a $5.5B disaster aid bill that will put money in farmers' pockets, AGCO's second quarter net sales improved by double-digits and CEMA's general Business Climate Index shows European ag equipment industry sentiment dropped slightly in July.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

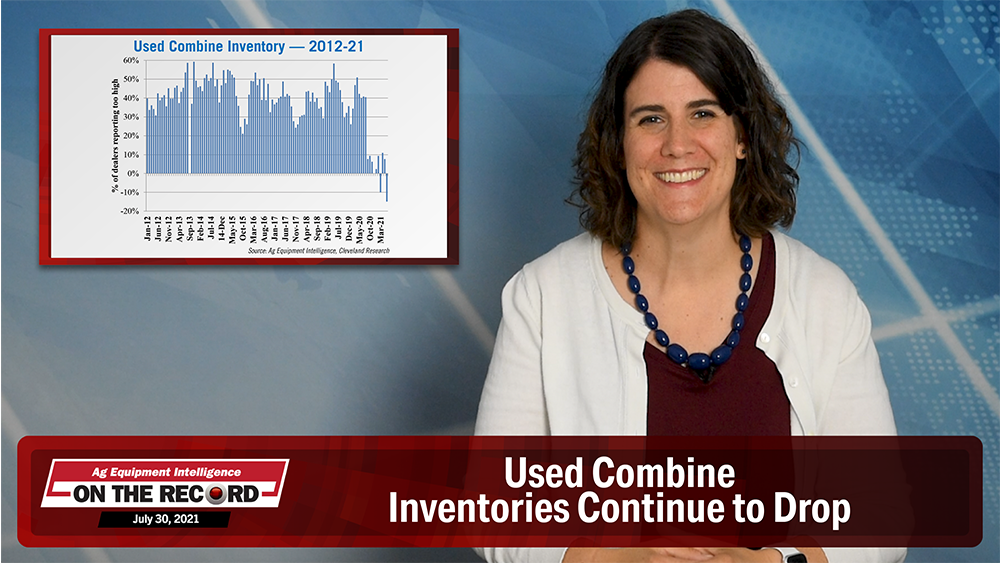

Used Combine Inventory Reaches Record Low

According to the results of the latest Ag Equipment Intelligence Dealer Sentiment & Business Conditions Update, a record net 15% of surveyed dealers indicated their used combine inventory was “too low” in June, a record low since the survey first began around 10 years ago.

In the July survey, 12% of dealers indicated their used combine inventory was “too high,” 61% said it was in line with the previous month and 27% indicated their used combine inventory was “too low.”

Commentary from dealers added more depth to the situation, with one dealer in the Corn Belt stating that they were running out of trade-ins because they have no equipment to sell. Another dealer from the southern plains region stated, “Our floor traffic is down due to low inventory. Our customers are calling around and buying from any dealer that has the equipment they are searching for.”

Dealers on the Move

This week’s Dealers on the Move are Potestio Brothers Equipment and Shreveport Tractor.

Colorado John Deere dealer Potestio Brothers Equipment has acquired Berthod Motors’ John Deere business. This adds a 4th location for Potestio Brothers.

Louisiana Kubota dealer Shreveport Tractor will end operations on July 31 after 50 years in business.

Study Highlights Environmental Benefits of Precision Ag

According to a study on precision agriculture conducted by the Assn. of Equipment Manufacturers, the American Soybean Assn., Crop-Life America and the National Corn Growers Assn., the environmental benefit of precision ag technology fuel efficiencies is similar to taking 200,000 cars off the road ever year.

The study, which is geared toward educating the general population about the benefits of precision ag technology, notes that cultivating an estimated 10.2 million acres of cropland was avoided due to more efficient use of existing land. That is the equivalent to 3.5 Yellowstone National Parks.

According to the study, productivity has increased an estimated 4% as a result of current precision farming adoption and has the potential to increase another 6% with broader adoption of precision technology.

Curt Blades, senior vice president of ag services for AEM, says the biggest opportunity with the most immediate need right now, however, may be in precision irrigation control.

The Western U.S. is currently facing the worst drought it has experienced in more than a millennium according to the U.S. Drought Monitor.

Already, the combination of variable-rate precision irrigation technology and soil moisture sensors is saving the equivalent of 750,000 Olympic-sized swimming pools of irrigation water per year, according to the study.

However, with full adoption, the U.S. could increase water savings an additional 21%, or nearly the equivalent of Cayuga Lake, the second largest of the Finger Lakes in Upstate New York.

But, to realize some of this additional savings and environmental advantages, the U.S. needs more bandwidth, Blades says. Enter the push for rural broadband and an infrastructure bill.

“The ag industry has been very loud with anyone that will listen to talk about how wireless in the future is needed for precision ag adoption. And I’ll credit this study for changing the hearts and minds of some of those folks that are writing those bills to say, it’s not just to the anchor institutions and the houses, but it’s also wireless in the field and they’re listening because they recognize that there’’ a bigger societal gain. If you’ve got that wireless in the field, like we want, that allows for all kinds of things to happen.”

House Ag Committee Approves $8.5B Disaster Aid Bill

On July 27, the U.S. House of Representatives Committee of Agriculture passed the WHIP+ Reauthorization Act, which would reactivate the Wildfire and Hurricane Indemnity Program Plus for 2020 and 2021 disasters.

The bill states it will continue the 2019 WHIP+ program as it was operated previously and has been authorized a total appropriation of $8.5 billion. Payments to farmers will be limited to $250,000 per person, while those with high-value crops will have a payment cap of $900,000. The bill will also lower the requirements for farmers to qualify for drought losses.

The Wildfire and Hurricane Indemnity Program Plus originally provided payments to producers to offset losses from hurricanes, wildfires and other qualifying natural disasters that occurred in 2018 and 2019. The original program covered losses of crops, trees, bushes and vines that occurred as a result of those disaster events, milk losses due to adverse weather conditions and losses to on-farm stored commodities.

Congressman Mike Thompson, who represents California’s 5th congressional district and is a member of the House Agriculture Committee, said:

“From extreme fires to historic drought, our district and our nation have seen devastating disasters this year and last year. Earlier this year, I introduced the WHIP+ Reauthorization Act to ensure we reactivate the critical Wildfire and Hurricane Indemnity Program Plus to help agricultural producers in our district. Today I’m glad to see my bipartisan bill approved by the Agriculture Committee, and I’ll work to ensure it’s considered on the House floor as soon as possible.”

Groups that have expressed support for the bill include the National Farmers Union, the American Farm Bureau Federation, National Milk Producers Federation, National Sorghum Producers and the National Cotton Council.

AGCO 2Q Sales Improve Double-Digits

This week AGCO released its second quarter earnings report. Net sales for the second quarter were approximately $2.9 billion, an increase of approximately 43.5% compared to the second quarter of 2020.

Net sales for the first six months of 2021 were approximately $5.3 billion, an increase of approximately 33.6% compared to the same period in 2020. Excluding favorable currency translation impacts of approximately 6.3%, net sales for the first six months of 2021 increased approximately 27.3% compared to the same period in 2020.

Looking at regional performance, all regions saw double-digit sales growth during the quarter. The largest increase was in the Asia/Pacific/Africa region, where second quarter sales were up 56.7%. That was followed by South America at up 55.9%. Europe/Middle East sales increased by 45.5% and North American sales for the quarter were up 32.2%

European Ag Equipment Industry Sentiment Down Slightly in July

After peaking in May and June at its highest level since 2008, CEMA's general Business Climate Index for the Ag Machinery Industry in Europe declined by 4 points in July to a reading of 68.

While current business sentiments remain positive, fewer companies are expecting further turnover growth for the coming 6 months. For expectations for upcoming order intake, the shift was even more pronounced: the share of survey respondents expecting an increase in orders dropped to less than a third, the lowest level this year.

More than 90% of the companies participating in the survey expressed concerns about supply bottlenecks, while 36% of the respondents from tractor manufacturers expect a production stop due to a lack of certain parts in the coming month.

Despite all uncertainties, the European industry representatives remained confident about closing the year with strong results. With regard to the full year 2021, the average survey participant’s forecast for their company was a turnover increase of +12%.

Post a comment

Report Abusive Comment