In this week’s episode, we take a look at how late planting will have implications across the entire ag supply chain. In the Technology Corner, Michaela Paukner examines Deere’s vision for autonomous farming. Also in this episode, Titan Machinery’s 1Q 2023 revenue increased nearly 24% and a look at what types of equipment growers are more likely to favor shortlines for over a unit from one of the majors.

To learn more about Agrisolutions and their globally recognized brands, such as Bellota, Ingersoll Tillage and Trinity Logistics, visit Agrisolutionscorp.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

Late Planting Impacts the Ag Supply Chain

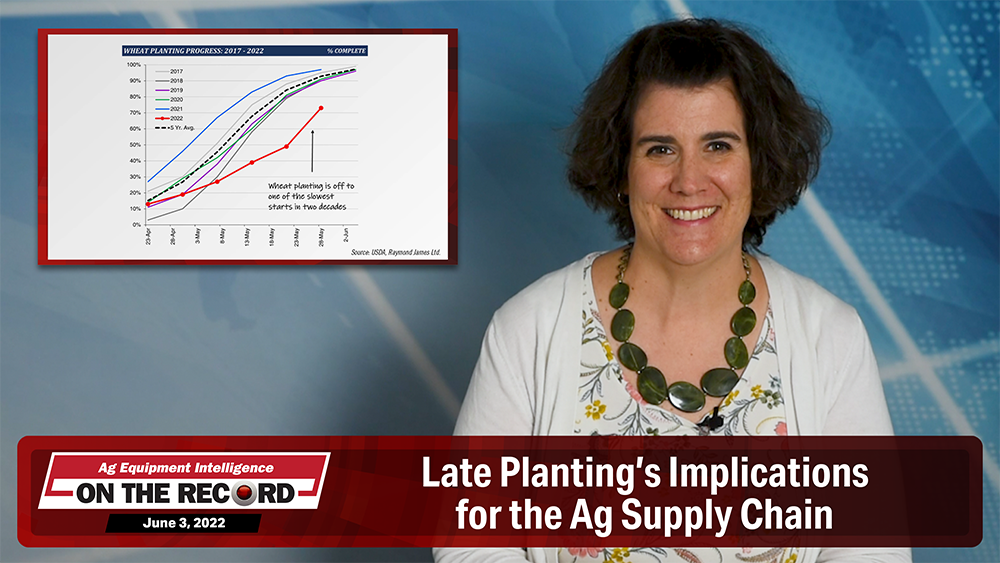

Cold, wet weather across much of North America this year has meant we’ve seen one of the slowest starts for planting in a decade. While U.S. corn and soybean planting has recovered to nearly the 5-year average, wheat planting is off to one of the slowest starts in two decades, according to a report by Raymond James analyst Steve Hansen.

However, in Canada, while planting in Alberta has made strong progress in recent weeks, in Saskatchewan it has been particularly slow in the eastern half of the province due to excess moisture and flooding.

However, in Canada, while planting in Alberta has made strong progress in recent weeks, in Saskatchewan it has been particularly slow in the eastern half of the province due to excess moisture and flooding.

Hansen notes that While still too early to make a definitive call, industry data suggest atypically late plants are often associated with late harvests and below-average yields, ultimately raising questions about the size and quality of the 2022 harvest. And he says, it could have implications across the entire ag supply chain — from ag retailers and equipment dealers to the Canadian rails.

Hansen notes that While still too early to make a definitive call, industry data suggest atypically late plants are often associated with late harvests and below-average yields, ultimately raising questions about the size and quality of the 2022 harvest. And he says, it could have implications across the entire ag supply chain — from ag retailers and equipment dealers to the Canadian rails.

Hansen says the late plant is likely to push some equipment purchase decisions until growers have a better idea on what the crop will ultimately look like. For ag retailers, Hansen says while still expected to be robust, a portion of spring input demand will likely slip into the third quarter. And, a late fall harvest also raises the prospect of a narrower fall application window before winter hits.

Dealers on the Move

This week’s Dealers on the Move include Tellus Equipment, LMS Ag Equipment, Robert’s Farm Equipment, Stewart’s Equipment and United Ag and Turf.

Texas John Deere dealer Tellus Equipment has acquired Clark Tractor and Supply’s 2 locations, bringing its total footprint to 24 stores.

AGCO dealer LMS Ag Equipment has broken ground on a new location in Steinbach, Man. This will be the dealership’s second location.

Ontario-based New Holland dealer Robert’s Farm Equipment has acquired two locations from Kubota dealer Earth Power Tractors & Equipment.

Kubota dealer Stewart’s Equipment has acquired the last location of Earth Power Tractors & Equipment in Stayner, Ont.

John Deere dealer United Ag and Turf has acquired 2 Long Island locations of Chief Equipment, bringing the dealership to 65 ag stores.

Technology Corner

John Deere is sizing the addressable market from its technology offerings to be an incremental $150 billion.

Company leaders outlined Deere’s vision for autonomous farming at its Leaps Unlocked technology event last week.

To accelerate adoption of autonomy, Deere plans to include autonomous sensors in the base configuration of the 8R tractor in the next few years — with the goal of having an autonomy kit on every large tractor that ships.

The technology Deere is using to power its autonomous 8R tractor will eventually be deployed to the entire fleet doing other jobs, according to Igino Cafiero, CEO of Bear Flag Robotics, the autonomous driving technology startup acquired by Deere.

Cafiero says by 2030, Deere plans to have an autonomous system that can do spring tillage, planting, spraying, harvest and fall tillage in corn and soybeans.

Deere’s technologies paired with the large fleet of Deere machines in use worldwide gives the company the advantage of scale.

“With these 3 technologies — cameras, edge computing, machine learning — as well as the scale of our fleet, we’re able to develop new robotics and artificial intelligence products much faster than anyone in the industry, and this sets us up to unlock the $150 billion of incremental addressable market. Building on our 180-year-old roots as a world-class manufacturer, we are now set up to become a world-leading robotics and artificial intelligence company.”

The addressable market includes potential savings on herbicides and fertilizers, improved yields and fewer labor expenses.

Analysts at investment firm Stifel say capturing a portion of these markets is a key driver behind Deere’s target of 20% equipment operations margins by 2030.

The analysts write: “DE expects these technologies to ultimately help increase revenue from less-cyclical recurring revenue from technology solutions priced on a per-acre basis as well as additional aftermarket opportunities. DE sees potential for these less-cyclical revenue to reach ~40% of total over time and account for an even greater portion of overall earnings.”

Titan Machinery Reports 24% Revenue Growth in 1Q23

Titan Machinery reported its first quarter earnings for fiscal year 2023 on May 26. Revenue for the quarter was $461 million up nearly 24% vs. the first quarter last year. Equipment sales were $356.4 million for the first quarter, up 29% from the same period last year.

Parts sales came in at $68.6 million, an increase of 9.5% compared to the same quarter last year. Revenue generated from service was $29.5 million, up 6.6% from a year ago. Rental and other revenue came in at $6.6 million for the first quarter, up 2.5% vs. last year.

Parts sales came in at $68.6 million, an increase of 9.5% compared to the same quarter last year. Revenue generated from service was $29.5 million, up 6.6% from a year ago. Rental and other revenue came in at $6.6 million for the first quarter, up 2.5% vs. last year.

Agriculture revenue for the first quarter of fiscal 2023 was $318.5 million, compared to $229.6 million in the first quarter last year. Chairman and CEO David Meyer said during the earnings call, "At the segment level, our agriculture segment benefited from robust demand which was supported by an increase in equipment deliveries from our suppliers following a delay in fiscal fourth quarter 2022.”

CFO Bryan Knutson noted that both new and used equipment demand is the highest the dealership has seen in decades.

During the first quarter, Titan’s inventories increased to $494.2 million as of April 30, 2022, compared to $421.8 million as of Jan. 31, 2022. This inventory increase includes increases in new equipment inventory of $65.6 million and parts inventory of $8 million, which is partially offset by a $2.1 million decrease in used equipment inventory.

During the first quarter, Titan’s inventories increased to $494.2 million as of April 30, 2022, compared to $421.8 million as of Jan. 31, 2022. This inventory increase includes increases in new equipment inventory of $65.6 million and parts inventory of $8 million, which is partially offset by a $2.1 million decrease in used equipment inventory.

Farmers Prioritize Value When Buying Shortline Equipment

A recent survey of North American farmers from Farm Equipment found that value remains growers’ top priority when looking at shortline equipment.

When asked for their primary reason to purchase a shortline product over a major line’s, 42% of farmers said price. This was in line with the 42% who selected this option in last year’s shortline survey.

The second most popular reason was a lack of comparable products made by majors at 24%, up from the 21% last year. Some 15% of growers said a shortline’s experience in a niche area was their top reason to pick that brand, down from 18% last year.

Among write-in responses in the “other” option, farmers mentioned the build quality, ease of repair and proximity to their dealer as reasons to go with shortline equipment.

Farmers were also asked to pick the category of equipment where they’re mostly likely to pick a shortline over major line equipment. Almost 35% of farmers said they’re most likely to purchase shortline seeding equipment, followed by tillage equipment at 26%. Another 17% said they’d buy shortline hay equipment. Just 3.3% of surveyed farmers said they’d be most likely to buy shortline harvesting equipment.

Farmers were also asked to pick the category of equipment where they’re mostly likely to pick a shortline over major line equipment. Almost 35% of farmers said they’re most likely to purchase shortline seeding equipment, followed by tillage equipment at 26%. Another 17% said they’d buy shortline hay equipment. Just 3.3% of surveyed farmers said they’d be most likely to buy shortline harvesting equipment.

Post a comment

Report Abusive Comment