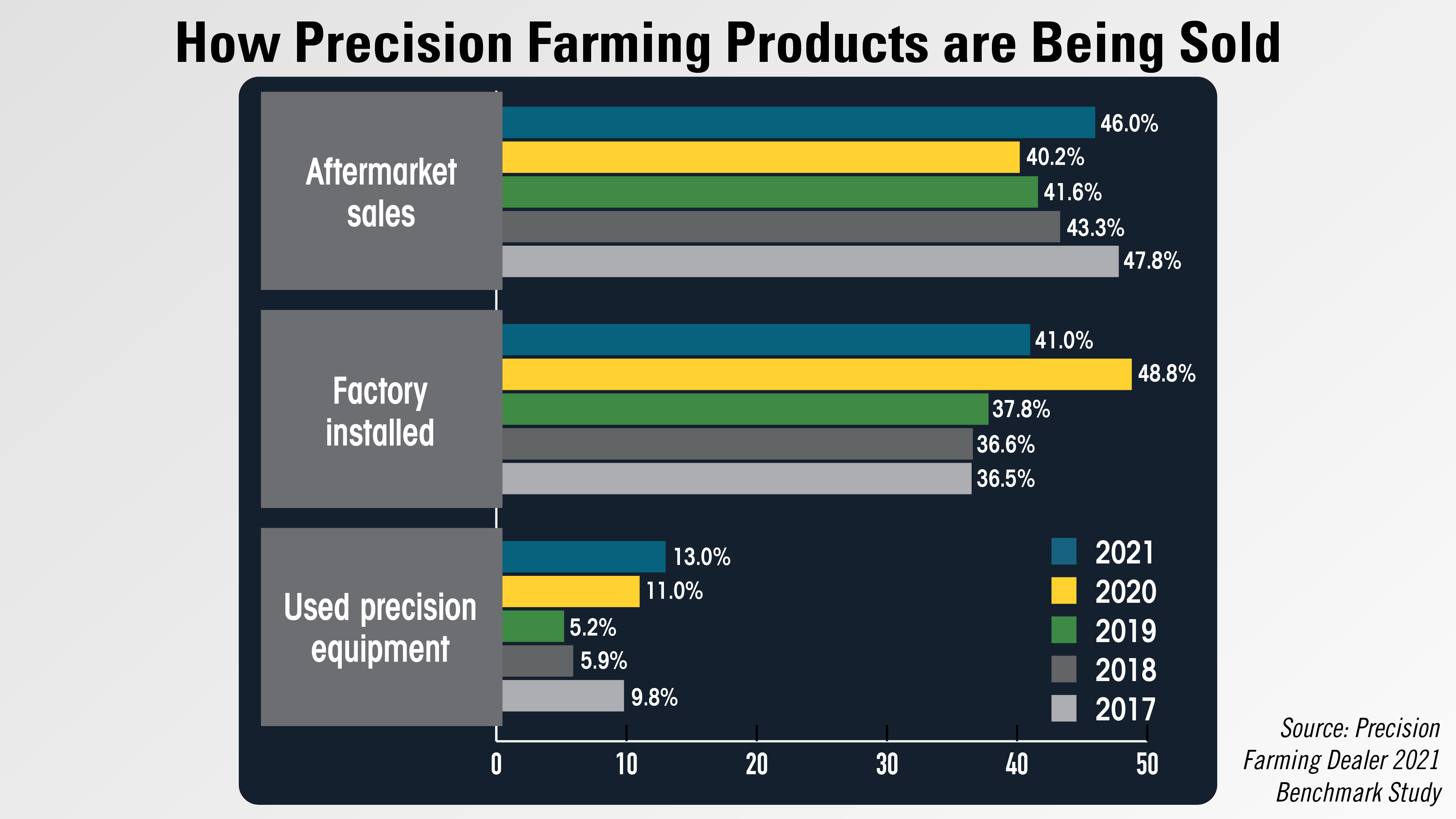

After 5 years of dealers reporting declining aftermarket precision sales, in the 2021 Precision Farming Dealer Benchmark Study, 46% of dealers said their precision products are being sold as aftermarket sales vs. 40% in last year’s study.

The percentage of dealers selling their precision farming products through aftermarket had declined since 2017 when 48% of dealers said that’s how they sell their precision products.

The percentage of dealers who reported precision products were being sold factory-installed declined to 41% vs. 49% in 2020. This is after several years of growth in this category, from 37% in 2017 to 49% in 2020. Used precision equipment sales saw a slight increase to 13% from 11% in 2020, a record high for the last 5 years.

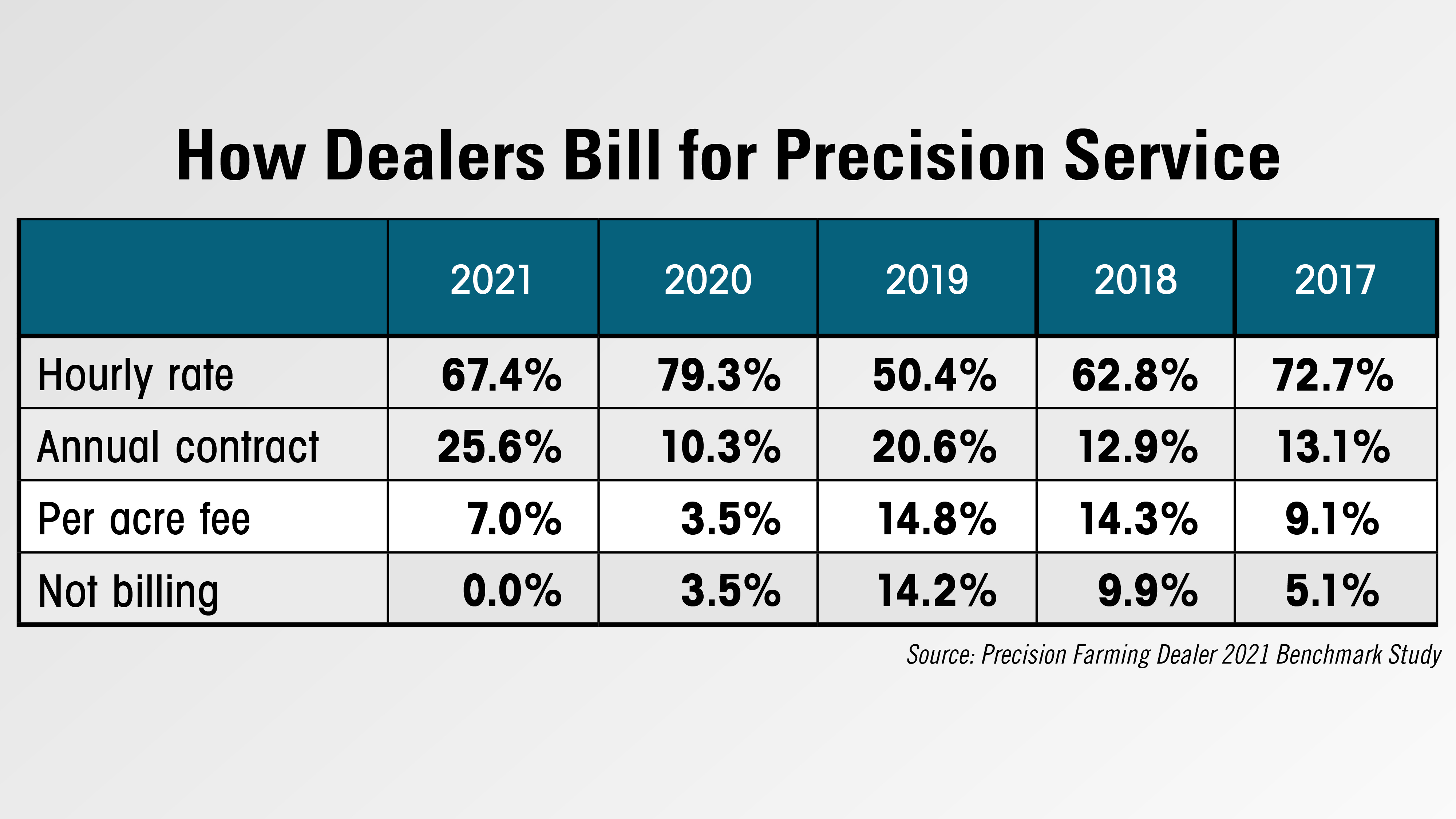

As more equipment comes with precision tech factory-installed, there’s been a push to focus the precision business on service and billing customers accordingly. The number of dealers who are billing for precision service via annual contracts increased to 26% in 2020 from 10% last year. Billing an hourly rate continues to be the most popular method dealers use, with 67% of respondents saying the bill this way, but this was down from 79% in 2020. Just 7% of dealers are charging a per acre fee.